Look Over My Shoulder: My Sunday Money Date Explained!

I don’t know about you, but I need systems and processes in my life that help me make sure I’m on track to meet my goals. Without my systems and processes, my life quickly falls into chaos!

In today’s blog, I’m going to walk you through my weekly process for assessing my progress on my yearly financial goals.

I begin my process by setting my intention for the week, transferring appointments to my paper calendar, blocking my time, etc. But today I’m going to walk you through a specific piece of the process I call my Sunday Money Date.

“Sunday” because I always take an hour or so every Sunday afternoon to prepare for my week, and “Money Date” because it’s time I specifically set aside to review where I am with all my money. By “all” I mean, checking accounts, savings accounts, investment accounts, retirement accounts, and, of course, bills and credit cards.

How I Set Up My Bill Calendar

I start this process by transferring all my regular personal and work appointments from my online (digital) calendar to my paper calendar. My online Google calendar is my Source of Truth, but some appointments need to be in my face more than others, so I also use a paper calendar.

I keep track of my regular bills on a specific “sub” calendar I created within my Google calendar which I call “My Bill Calendar”. Right away, I toggle this calendar on so I can remind myself of what bills are coming up in the current week.

In the category of “things that need to be in my face” are big bills or bills I need to manually pay. I usually add those to my paper calendar at this point, too, so I don’t forget about them.

Now, we get into the nitty gritty of my Sunday Money Date.

The Money Date Checklist

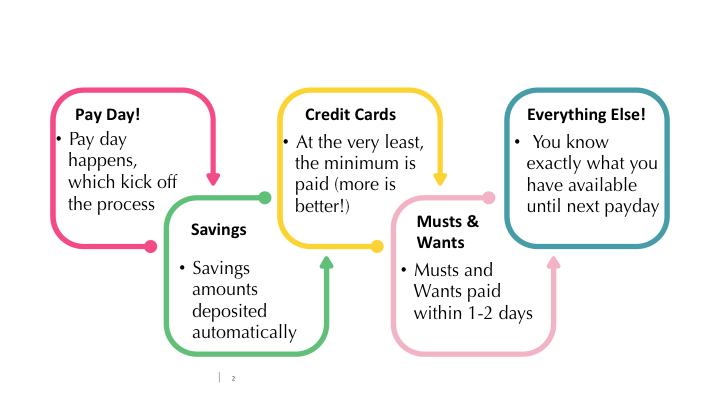

The Money Date Checklist is my weekly checkpoint for my entire Paycheck Clinic Money System (see graphic below). The first thing on my list is to login to my bank account.

Then I run through my checklist:

I review my savings accounts balances to make sure I’m on track to meet my yearly goals for each of my savings accounts:

“Everyday Average Emergency” Fund

Emergency Fund (“Rainy Day Fund”)

Vacation/holiday fund

Other savings accounts I may have set up for any other savings goal

Then I review my Checking Account

I check the balance in my checking account

I check my google bill calendar to see what’s coming up this week and do a quick calculation in my head to double check for any cash crunches

If there are other expenses coming up during the week like birthday presents, car maintenance like an oil change or something, I usually add all those to My Bill Calendar, too, so I don’t forget

I also review any credit card charges and make sure the balance has either been paid, or is on track to be paid

Other things you might check and/or add to your My Bill Calendar

School loan payments

Tuition payments

Nanny payments

Landscaper if you have to write a check

Misc medical or dental bills

Now, I'm Setup for a Great Week!

Yep, that’s it! That’s my whole Sunday Money Date process. The process takes less than 15 minutes. I know exactly how much is in my checking account to get me through the week. I’ve checked my savings accounts to make sure I’m on track for my savings goals.

I’ve added any expenses I know are coming up during the week to my Calendar, and I’ve made sure I’ve reviewed my credit card charges and balances.

I now feel organized, empowered, and ready to take on the week!

Need an Online Bill Calendar, too? I got You!

If you would like to know how to create YOUR own customized, online Bill Calendar, please check out my NEW class HOW TO BUILD YOUR BUDGET RIGHT IN YOUR CALENDAR!

Skillshare is an online learning platform that is A-Mazing. You can learn everything from how to budget using your calendar with me, but you can also learn watercolor painting, graphic design skills at all levels, and how to do video editing. And tons and tons more!

With the link below you get your first 30 days free and you can watch my class FOR FREE as part of your subscription!

Here’s the link to get your first 30 days for FREE! https://rebrand.ly/SKBillCalendar

You can cancel at any time :-)

The Paycheck Clinic System

This is my system to make sure my money is flowing into all the places it needs to go easily and efficiently!

**I am not a licensed financial advisor. I am a money expert and I provide education, tips, tricks and my opinions around money. You should consult a professional who understands your needs in order to make the best decisions for you! Additionally, some links in this blog may be affiliate links, which means if you click the link and buy the product I may earn a small commission - at NO COST to You! It’s one of the ways I keep the lights on around here so TYIA! 😉