How to Save AND SPEND Your Tax Refund or Bonus!

Do you have a favorite recipe? You know, one of those go-to recipes that you can pull out of your back pocket and make with your eyes closed?

That’s what my F3P Strategy for Saving is for me.

A tried and true recipe that is quick, easy, and always gets me closer to my financial goals and today I’m sharing it with YOU!

Think of this as my family recipe you can now customize to your liking. 😉 😉 😉

It’s a starting place. Feel free to spice it up and make it your own!

My strategy for Tax Refunds, Bonuses and Money that falls out of the sky!

I call it my F3P Strategy for Saving

(Yes, I’m lousy at naming things. I’ll keep working on it. But for now, this is it!)

Here’s my basic philosophy when it comes to allocating things like tax returns and bonuses:

Some for the Future

Some for the Past

Some for the Present

And some to Pay it forward

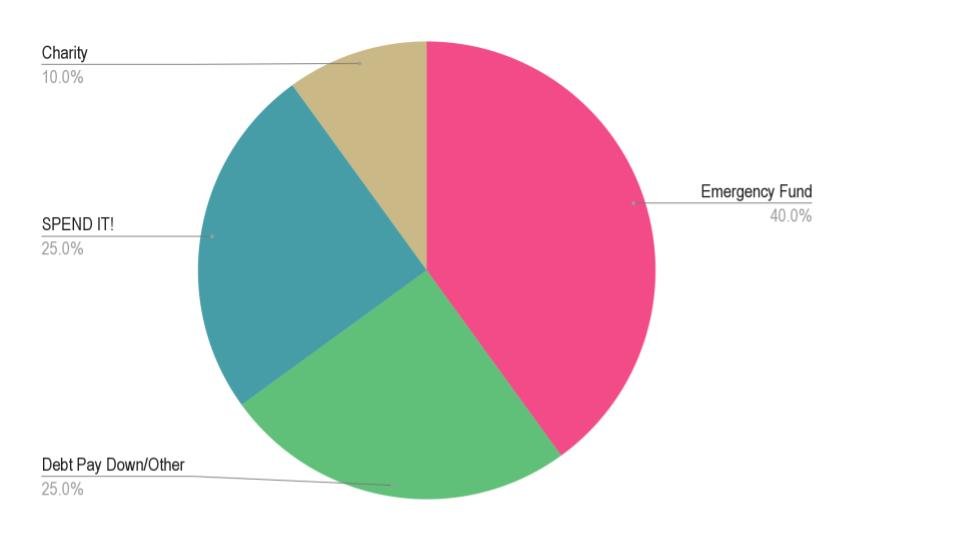

Here's a graph of what I'm talking about:

First, let’s take care of our Future.

Some for the Future: Your Emergency Fund

We all hope nothing bad ever happens, but history tells us that it could, so we best be prepared. That’s where an emergency fund comes in.

I’ve written several blogs about what an emergency fund is and how to save one, which you can find HERE.

A good rule of thumb for an emergency fund is three months’ worth of net paychecks.

So, let’s start there.

If you don’t have at least three months of net paychecks tucked away in an emergency fund account, then I suggest you put 40% of the tax refund/bonus/windfall in this account.

If you do have at least three months of net paychecks in your emergency fund, then you have two options.

The first option, start working towards six months of net paychecks and deposit the 40% of the refund or bonus in your emergency fund. Or, option number two, put it towards any credit card debt, school loans, or car loan you have.

But, what if you have six months of net paychecks in an emergency fund and you don’t have any credit card debt or school loan debt, or even a car loan?

First of all: You Go Girl! You are out there living your JoyFULL Life and have created an amazing financial foundation for yourself. You need to reach up and give yourself a pat on the back for your awesomeness! (Why are you even reading this blog, you should be writing one of your own, lol!)

Next, there’s always your mortgage, the house project you're saving for, your investment account (because I’m guessing you have one), or that once-in-a-lifetime vacation you’ve been saving for. Be sure to DM what you decide because I want to celebrate with you!

Now that we’ve taken care of the Future, let’s take care of the Past

Some for the Past: Pay Debt

The sooner you can get any debt you have paid off, the sooner you get to keep all that fluffy money for yourself! Debt is all about decisions or purchases from the past, and those decisions now include monthly interest. This is why paying debts off as fast as possible simply makes good financial sense.

For this step, I recommend putting 25% of the bonus or refund towards your highest-interest debt.

But, wait, why not put 40% towards the debt and 25% towards the emergency fund if it’s so important to pay off the debt?

Awesome question, and that’s exactly what I used to recommend.

But then, the pandemic happened and the world changed...

During that time, I had many friends, relatives, and co-workers either lose their job or have to leave their job to take care of children or aging parents.

Practically speaking, not all bills can be put on a credit card.

Mortgage companies, landlords, and finance companies typically will not accept a credit card as payment because they don’t want to have to pay the credit card processing fees on their side. They will only allow payments from a checking or savings account.

My friends and coworkers needed cash, and so will you. That’s why I now say 40% towards your emergency fund and 25% toward debt payment.

Some for the Present: SPEND IT!

You’ve taken care of your future, and you’re paying down the past - now it’s time to have some FUN in the present!

Take 25% of your bonus or refund - AND GO HAVE FUN!

That’s right. SPEND IT. BLOW IT. GET CRAZY!

All of us work hard every day. When there’s an opportunity to celebrate - Let’s CELEBRATE! There’s nothing wrong with having some fun. Our money should support our life and it’s okay to take a little pleasure from the fruits of your effort.

You have taken care of your future, and paid off some of the past so now, go have fun. Buy something pretty (guys, too!)

Go live your JoyFULL Life!

And, Some to Pay it Forward

Paying it forward is something that actually weighs on my mind. I have so many blessings in my life and paying them forward fills me with gratitude for those blessings.

I also feel like a productive citizen of the world, and well, a good human when I pay it forward. I chose ten percent because that’s the amount I was taught to tithe as I was growing up. It’s an amount that feels right to me.

Additionally, I’ve worked with a lot of nonprofits and any little bit of cash that comes in during the year is a godsend. Most only receive donations during the holidays or if they run a big fundraising drive. Fundraising drives help, but there are still expenses associated with it, so the nonprofit doesn’t get to keep everything they receive. Donations that are free and clear of other encumbrances are icing on the cake for them!

Conclusion

That’s it! That’s my recipe, so to speak, for saving - and SPENDING - any tax refund/bonus/etc., that I might receive.

The reason I think this works is that it’s touching on all the pieces of any person’s financial foundation.

A little bit of money is added to the emergency fund, a basic building block of everyone’s financial wellness. A little bit of debt gets paid off, and even better, you’re probably paying down the principal. You’re also paying it forward, which is being a good citizen and steward of your community.

Finally, you’re allowing yourself to have a little FUN! Making time and space for fun in our lives is where the good stuff lives. Always make room for the good stuff.

So now, take my recipe and make it your own! Tweak the percentages and make them work for you and your situation. Spice it up as much as you want!

And then be sure to DM me over on LinkedIn or Instagram and let me know how it goes!

Love,

Michelle

XOXO

**I am not a licensed financial advisor. I am a money expert and I offer education, tips, tricks and my opinions around money. You should consult a professional who understands your needs in order to make the best decisions for you! Additionally, some links in this blog may be affiliate links, which means if you click the link and buy the product I may earn a small commission - at NO COST to You! It’s one of the ways I keep the lights on around here so TYIA! 😉