Does Closing a Credit Card Hurt Your Credit?

You’ve worked super hard and have paid off a credit card - Go You!

Now, should you close that credit card? Well...maybe? But, maybe NOT. If closing it would make your total overall available credit a lot lower when compared to the total amount you owe, then you might not want to close that card.

Let me explain.

What is a Utilization Rate?

In order to decide if you should close a credit card, you have to look at ALL of your debt, not just that one card. This is because of something called your “utilization rate”?

Your utilization rate is also sometimes called your debt-to-limit ratio or your debt-to-credit ratio. These are fancy words but don’t worry, they are easy to understand.

Your utilization rate tells the credit bureaus the total amount of credit you COULD be using compared to the total amount of credit you ARE using. The credit reporting bureaus use this rate/ratio when calculating your credit score.

Additionally, your utilization rate will affect your overall credit score. The total amount you owe affects about 30% of your credit score. Keeping your utilization rate as low as you can will help keep your credit score as high as possible.

Which is, after all, the Big Goal!

How to Compute Your Utilization Rate

The easiest way to explain your utilization rate, or debt-to-credit ratio, as well as how to calculate your utilization rate, is with an example.

So, here goes:

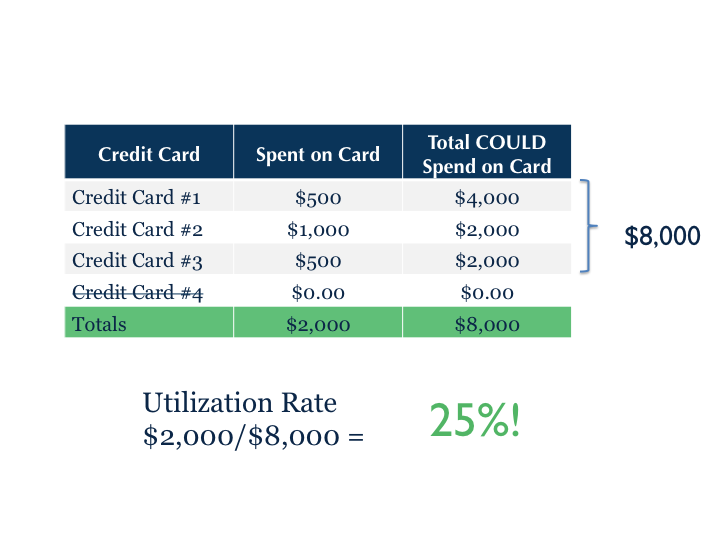

Let’s say you have Four credit cards. You owe $2,000 on three of them. The fourth one you just paid off. Yay you!

Across the four cards, you have $18,000 Total Available Credit you COULD spend.

This means you have a utilization rate of 11% - which is really good! (more on that below)

Now, let’s say you CLOSE that fourth card. You still owe $2,000 on the other three cards but now you only have $8,000 you could spend. That is, you only have $8,000 of Total Available Credit. This means that your utilization score INCREASED to 25%. In other words, you’re using a greater percentage of the total available credit than you were using when you still had that fourth card open.

Generally speaking, when your utilization rate goes UP ⬆️ your CREDIT SCORE goes DOWN ⬇️

A general rule of thumb is that a credit utilization ratio under 30% is acceptable. So, while a 25% ratio is not terrible, it’s certainly not as good as an 11% ratio.

Plus, having a higher utilization rate may affect the interest rate you’re able to get on any big purchases you’re planning to finance in the near future, like a house or a car. Because, as I said above, a higher utilization rate may make your credit score go down.

What is a Good Utilization Rate?

In general, you want to make sure you keep your utilization rate under 30% at a minimum, and 10% is considered ideal.

If you’re trying to reach that magic credit score of 850, then you might want to consider keeping it right around 1%. Believe it or not, 1% is better for your credit score than 0%.

(If you’re interested in why, drop me a DM and I’ll write another blog just for you!)

So, Should You Close the Credit Card?

Whether you should close the credit card or not comes down to your utilization rate. If closing the credit card will INCREASE your utilization rate -- and thus potentially lower your credit score -- and you are considering buying a house or a car, then maybe not.

In that case, perhaps what you want to do is buy the house or the car, get the mortgage or car loan, and THEN close the card.

If you’re afraid you might run the balance up again (trust me, I get you!), then you can always call the company and have them freeze the card so you can’t use it, or even cut the card up so you can’t use it. I call this type of behavior “parenting myself”, lol.

What’s Your Next Step?

If the first step in knowing whether or not it’s going to hurt you to close a credit card is to calculate your utilization rate, then the step BEFORE that is to know how many credit cards you have and their total balances. The best place to get that information is from your credit report.

The best place to get your credit report, and the ONLY site that I know of that is completely 100% Free - meaning no fee AND they won’t want your email address so they can spam the heck out of you is www.annualcreditreport.com**.

Once you get your credit report, you’ll want to review it. If you’re not sure how to do that, I have a free resource for you that helps you review your credit report for accuracy - CLICK HERE to get it.

Again, click here to get my free CREDIT REPORT REVIEW CHECKLIST!

Want more information about your credit report and credit score? Check out these other blogs:

Everything You Need to Know About Your Credit Report

How to Read Your Credit Report

What is a FICO score...and Why Do I Care?

**I am not a licensed financial advisor. I am a money expert and I offer education, tips, tricks and my opinions around money. You should consult a professional who understands your needs in order to make the best decisions for you! Additionally, some links in this blog may be affiliate link, which means if you click the link and buy the product I may earn a small commission - at NO COST to You! TYIA :-)