What is a FICO Score and why do I care?

Here’s the bottom line: your credit score is like your financial grade. Think of it like your “adulting score”. Whether high or low, your credit score is critical to how much interest you’ll pay on anything you pay interest on!

When it comes to interest, you want to make as much as you can and pay as little as you can – your credit score helps you pay as little as you can. 👍 👍 👍

The Difference between a FICO score vs. a Credit score

FICO scores are calculated and maintained by a company formerly named the Fair Isaac Corporation, hence the F.I.C.O. or, FICO. Now, they just go by FICO.

There are other types of credit scores, such as the VantageScore, which was developed by the three credit reporting bureaus (Experian, Equifax, and TransUnion) as an alternative to the popular FICO score. FICO also uses data from the three credit reporting bureaus to calculate their score.

However, when you hear the average person say “credit score” that person usually means your FICO score, as that score is the most well-known of the two.

Regardless of which credit score we’re talking about, your score is based on how well you pay your bills that are specifically related to the use of credit. That is: loans you’ve taken out or credit cards you have.

How is Your Credit Score Calculated?

A credit score is based on such things as how much credit you are using versus how much you could be using (your utilization rate), if you’ve made any late payments, how often you’ve made late payments, or if any accounts have gone to collections, things like that.

When calculating your FICO score, specifically, that score is broken up into the following categories and percentage weights:

Payment history – 35%

Total amount outstanding – 30%

The length of your credit history – 15%

Types of credit accounts you have – 10%

Recent credit activity – 10%

Other scores will have slightly different weighting systems, but they are all broken up into these general categories and weights. If you want to know even more about FICO scores check out this article HERE

What is a Good Credit Score?

Like I said at the beginning, credit scores are like your grade, so, just like in school the higher the better!

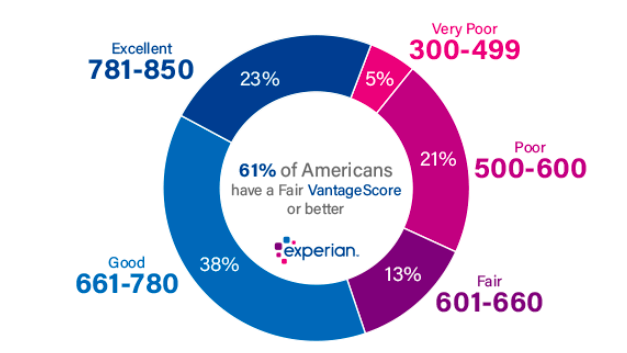

FICO scores can be anywhere from the low 300s to around 850.

VantageScores are very similar to FICO Scores. They both have five tiers or bands of scores, but the scope of the tiers is different. For example, a Very Poor score for FICO is 300 to 579. However, with a VantageScore, a Very Poor score is 300 - 499. Similarly, a Good score with FICO is between 670-739. While a Good score with VantageScore is 661-780. This means you can hit that “Good” score faster with VantageScore.

What’s the Benefit of a High Credit Score?

About thirty-five percent of your credit score is based on your payment history. That is, how well you pay your bills. Do you pay your bills on time? That will get you a higher score! YAY!

If you pay your bills late, and especially if you consistently pay your bills late, then your score will be lower. 😟 😟 😟

⬇️ ⬇️ This is why you care what your credit score is! ⬇️ ⬇️

When you pay your bills late the bank or credit card company views that as an indication that you aren’t reliable and even that you might not pay them back!

This means that lending money to you is riskier than lending money to someone who does pay his or her bills on time.

Paying your bills late and having high balances on your credit cards are the top two reasons your credit score goes down.

Lower credit scores mean higher interest rates. Higher interest rates also mean higher overall payments!

Take a look at this table. Everything is the same EXCEPT the interest rate:

Mortgage Amt Years Interest Rate Monthly Payment

$85,000 30 4.5 $430.68

$85,000 30 3.5 $381.69

The person who has to pay the first mortgage at 4.5%, pays $48.99 per month more than the person who got a mortgage at 3.5%.

BUT, over the life of the mortgage, the person who’s paying 4.5% will pay $17,638 MORE over the thirty years of the mortgage!! That’s at LEAST a FEW yearly vacations - IN INTEREST!

THIS is why you care what your credit score is!

How Risk and Interest Work Together

In the financial world, “risk” means the likelihood that an investment will actually earn the expected return. “Risk” shows up in financial transactions as interest, specifically, the interest rate. A higher interest rate means that there is a higher likelihood that the investment will not make as much money as expected.

So, the higher the interest rate, the “riskier” the investment.

If someone has a low credit score, the bank thinks that there is a higher “risk” that they won’t pay their loan or credit card in full, on time, or even at all.

This is why it’s super hard to get a credit card if you have a credit score below 500. That score is seen as “very risky”. If you have a credit score that low and you are able to get a credit card, you will likely have an interest rate that is very high. Maybe as high as 24.99 - 29.99%!

High risk = high-interest rate

The bank feels like if it’s going to take a risk, then they are going to make it worth their while by charging you interest out the whazoo!

Buuuuuut - Higher credit scores will get you lower interest rates when you apply for a loan or for a credit card because you will be seen as “less risky”! (See the mortgage comparison table above)

So, if you have a credit score of 700 or higher you will probably be able to get a credit card with an interest rate of 9.99% or lower!!

Major Savings of Interest!!

Check out my FREE CREDIT REPORT CHECKLIST: CLICK HERE!

Conclusion

Your credit score is your financial “grade”. It tells the bank and other financial institutions how well you manage your money, and therefore how well you will manage to pay them back.

Just like when you were in school, the higher the grade the better! A really good score is anything over 700 and a poor score is anything less than 600. The best way to keep your credit score up is to pay your bills on time.

If you need a super-easy way to budget, please have a look at my blog on my Easy Monthly Bill Calendar Method. The Bill Calendar method helps you manage your bills with someone you look at every day - your calendar!

Check it out here: Easy Monthly Bill Calendar Method

And, if you want to know more about your Credit Report, please have a look at this Blog: Everything You Need to Know About Your Credit Report!

**I am not a licensed financial advisor. I am a money expert and I offer education, tips, tricks and my opinions around money. You should consult a professional who understands your needs in order to make the best decisions for you! Additionally, some links in this blog may be affiliate links, which means if you click the link and buy the product I may earn a small commission - at NO COST to You! It’s one of the ways I keep the lights on around here so TYIA! 😉